Three Chinese motorcycle companies grow more than double: market out of control

Chinese companies are the main protagonists of the increase in registrations in July. However, not only them

The motorcycle and light vehicle sector closed the month of July with a notable boost in registrations. An upward trend that reflects the growing importance of two-wheelers in mobility is being consolidated.

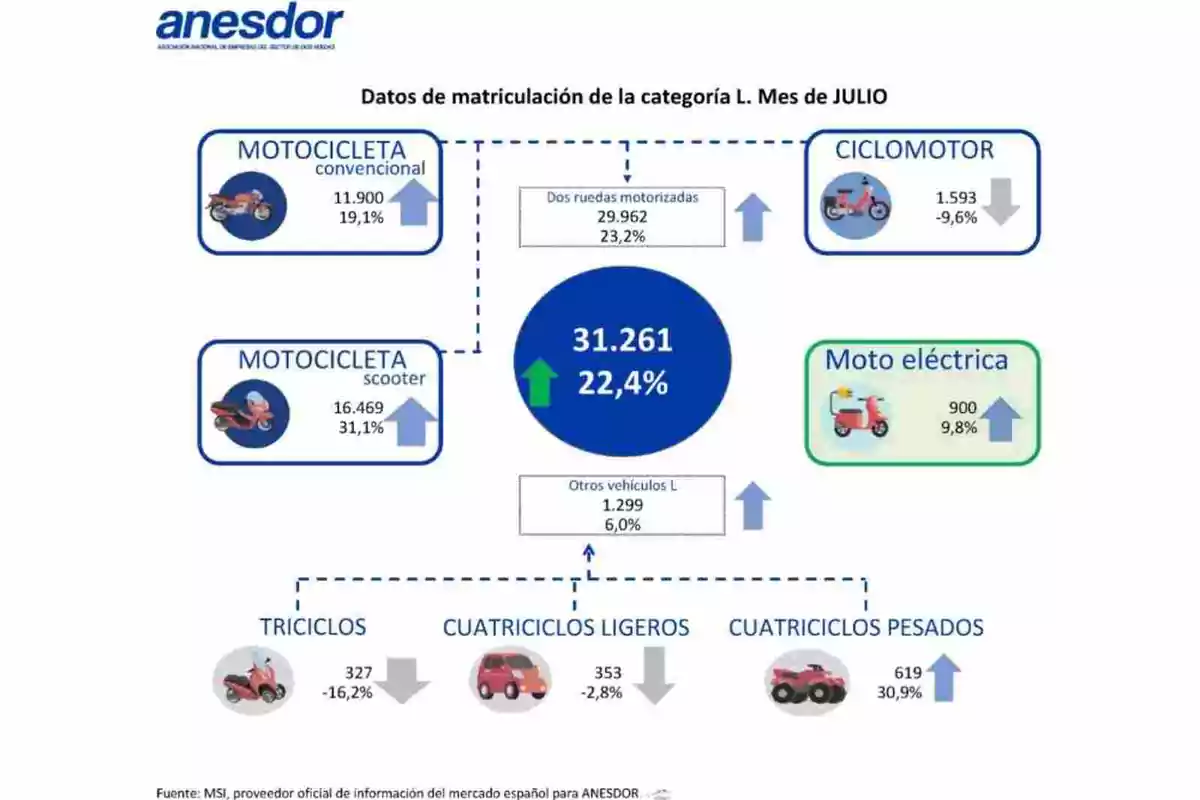

With 31,261 units registered, the increase compared to July of last year is 22.4%. This brings the annual total to 155,530 vehicles (+8.5%).

We're not just talking about numbers. Behind them, there is a demand that responds to the appeal of the motorcycle as an efficient, dynamic, and versatile solution in both urban and non-urban environments.

The bulk of the market is, of course, supported by motorcycles, which grew a solid 26% in July with 28,369 units. Scooters lead by a wide margin (+31.1% and 16,469 units), followed by road bikes (+23.3% and 11,445 units).

2025 is the paradigm shift

One more highly relevant fact from these July 2025 figures is found in the analysis of the brands in the "top 10." The three Chinese brands in this ranking have achieved a total that doubles their sales compared to 2024.

Zontes reaches the third position in the market (+123.7%), Voge the fourth (113.5%), and QJ Motor the tenth (122.9%). In no other European country is there such prominence of these Chinese firms.

Their quality-price ratio is decisive for understanding this effect. Meanwhile, this trend has caused the number of brands from the same origin to multiply in our country.

For now, only Honda and Yamaha keep their privileged status in the face of this new wave. The positive numbers extend to almost all the brands that occupy the "top 10 ranking." Only KYMCO (-5.4%) and Piaggio (-38.1%) are the exception in the 2024 total.

The motorcycle market by segments in July

The off-road segment, however, suffers a sharp correction with just 446 units registered (-36%). By sales channel, the boost has been widespread: companies (+26.8%), individuals (+26%), and rentals (+12.5%).

Mopeds follow a different trend. Their 1,593 registrations represent a drop of 9.6%, and the annual total shows a decrease of 2.1%. This is not surprising, given their status as a minority vehicle in a context where the urban 125 scooter takes center stage.

The analysis by Autonomous Communities places Catalonia, Andalusia, and the Valencian Community at the forefront of percentage growth. In absolute volume, Catalonia (7,216 units) and Andalusia (6,856 units) remain the driving forces of the market.

The behavior of the electric sector deserves special mention. In July, electric motorcycles and light vehicles grew by 13%, totaling 1,137 registrations. So far this year, the increase has reached 19%.

Electric motorcycles are experiencing the greatest boost (+58.6%), although with still modest figures. The company channel keeps this trend (+57.5%). By contrast, the individual channel shows a negative sign (-22.4%).

From the sector, however, it is emphasized that quantitative growth can't make us forget what is essential. The motorcycle is a vulnerable vehicle. Therefore, it is essential that public policies address accident rates from a structural perspective.

These strategies must be focused on the entire mobility system. Not only a punitive approach toward the motorcyclist group will reduce the problem.

More posts: